When stakeholders think of risks, they often focus on financial, regulatory, and technology risks, while only acknowledging operational risks. However, operational risks are often more pervasive as they often impact the inner workings and processes that span every aspect of the organization. A publication from IIA Norway defines four categories of operational risk as threats to the "physical assets, people, processes and the use of technology," which is the core of every organization. In this article, we will explore the categories of operational risk, operational risk management, and the role operational auditing plays in achieving strategic objectives:

- Understanding the four types of operational risks

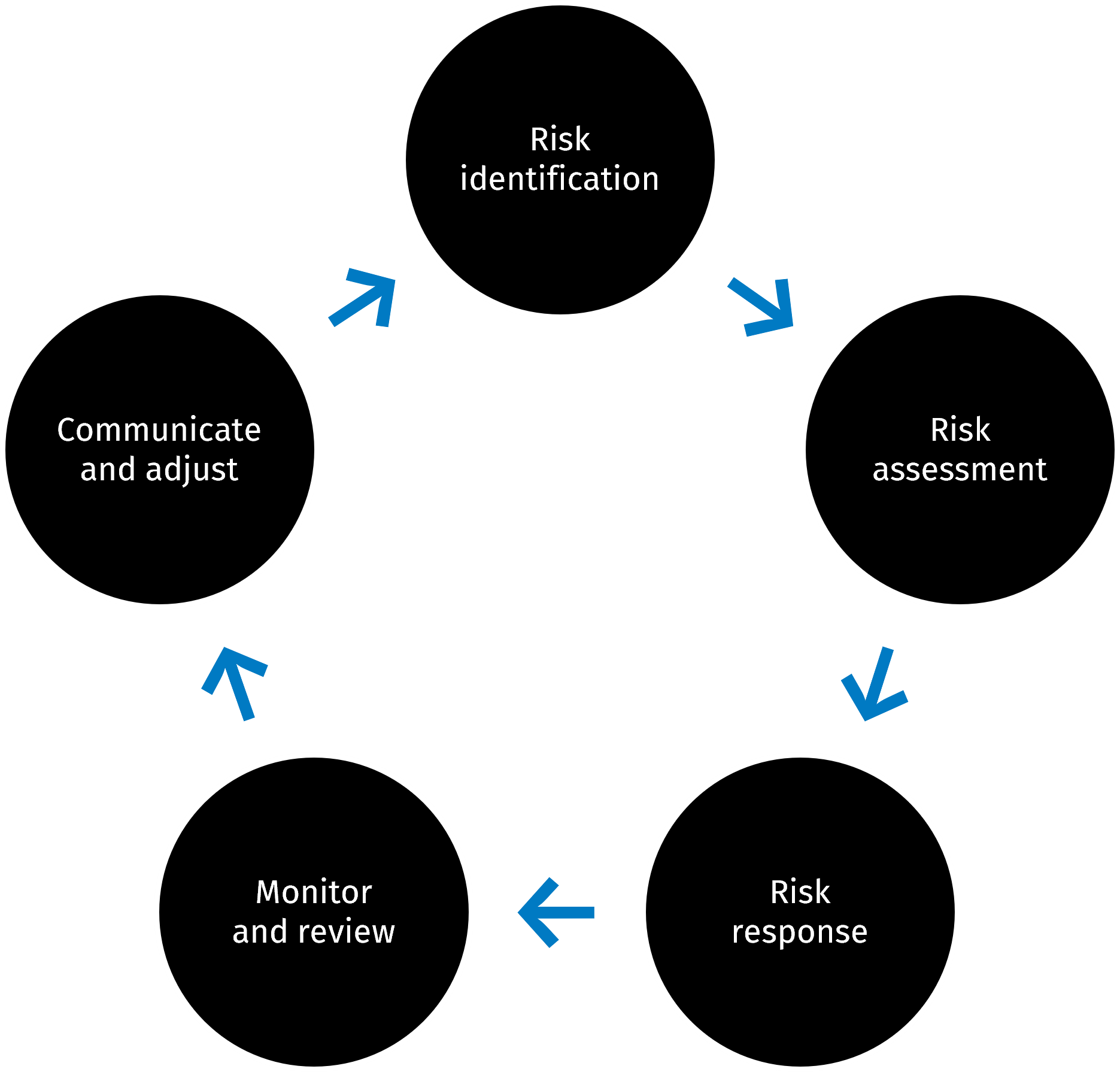

- Operational risk management (ORM)

- Operational auditing

- Benefits of operational auditing

Understanding the four types of operational risks

The scope of operational risks can seem overwhelming, so it is beneficial to break down the risk area into four basic categories: processes, assets, people, and technology.

Inefficient and ineffective processes

Internal processes define everything we do in an organization. We still begin most audits with a process walkthrough to understand how people work. From an operational risk management perspective, the process is the centerpiece. Instead of documenting a process for understanding, the focus is on process improvement to isolate and correct anything that detracts from operational excellence and/or fails to meet policy or regulatory requirements.

Loss of organizational assets

Protecting assets comes in several forms. The definition employed by most government agencies is the prevention of fraud, waste, abuse, and mismanagement; an understanding that works for any organization. In this simple framework, the goal is to implement internal controls to prevent the loss of organizational assets through fraudulent activities, squandering resources through wasteful practices, abusing authority to misdirect assets, or making bad decisions that allocate resources to unnecessary activities.

Human resource risks

All organizations need people, but we regularly underestimate the human workforce risks associated with hiring and terminations, workplace culture, employee safety, and training. Hiring the right person for a position is time-intensive, and making a poor choice can negatively impact the culture and your organization's reputation. Even with a high-performing staff, failure to properly train the team can lead to lost productivity, unsuccessful product releases, technical breaches, and other problems.

IT operations and technology risk

People generally use the term "IT Risk" to describe anything and everything with even a hint of technology involved; however, technology risk has many facets and nuances. As an operational risk, we can focus on the management of the IT function that oversees the activities related to IT operations and resources.