(Courtesy/Wolters Kluwer)

Tariffs could disrupt short-term adoption

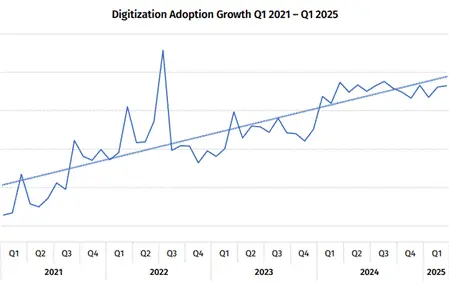

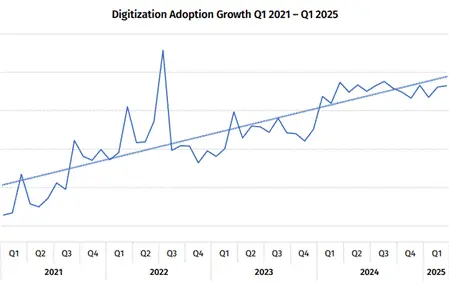

With “relatively significant levels of pre-tariff inventory” and a temporary increase in demand, electronic adoptions benefited from tariff-induced car purchases, Babcock said.

The tariff pull-ahead may boost the volume of digitally contracted loans through May, but tariffs may contribute to lower vehicle sales and a dip in overall origination volume thereafter, he said. However, short-term disruptions historically have not had a significant impact on the volume of electronically completed loans, Babcock said.

“In the short term, expect some disruption, but the trend toward digital seems to be moving full steam ahead,” he said.

ABS e-contracting falls 50 percent YoY

Meanwhile, the volume of e-contracted loans included in auto asset-backed securitization (ABS) transactions dropped 50% YoY but rose 13% QoQ and has increased 24 percent over the past four years, according to Wolters Kluwer.

The 51 auto ABS issuances totaling $47.3 billion in Q1 were down from 61 issuances worth $49.8 billion Q1 2024, Babcock said.

The decline reflects a change in the quality of ABS issuances in early 2024 rather than a significant downturn in transactions, he said. In 2024, a larger proportion of nonperforming receivables were included in ABS deals, resulting in larger but riskier profiles.

“The transactions tell a different story because some of those early 2024 issuances included such a large number of the nonperforming receivables that it really swayed the numbers,” Babcock said.

Auto Finance Summit East 2025 is set for May 12-14 at the JW Marriott Nashville, featuring fireside

chats with Santander Consumer USA and Chase Auto. Visit autofinance.live for more information.