From 2024, the National Bank of Belgium (NBB) is expanding its Belgian Extended Credit Risk Information System (BECRIS) to include individual credit information. The extension is part of the program to renew the overall credit data collection of the NBB. This is currently spread across different models and the reporting obligations vary dependent on data set.

For firms, this will bring new data collection challenges, demand changes in existing data models and affect data delivery timelines.

What is BECRIS?

The Belgian National Bank began collecting granular data on credit to natural persons in 2003. The NBB uses consumer credit and mortgage loans data, registered against individual persons, to measure the indebtedness of households and individuals.

As a response to AnaCredit, the NBB created a new data model and platform (BECRIS) replacing the existing credit register for cooperations (CKO/CCE). In 2018, credit institutions started to report credit contract information to legal entities into the new BECRIS corporate credit register (CCR). This allowed the NBB to comply with the ECB AnaCredit regulation and apply the ‘report-only-once' principle.

What’s changing?

The NBB is transitioning all credit data collection and consultation into a single platform, "BECRIS 2.0”.

The new expanded model will replace the current central individual credit register (CKP/CCP), which will be cancelled in 2024.

Individual Credit Information

From 2024, the BECRIS data model will include individual credit information, improving the overall credit data collection of the NBB. The BECRIS ICR reporting is applicable for institutions that are issuing credit contracts to natural persons:

- Credit institutions

- Social lenders

- Installment sellers

- Other financial institutions providing consumer credits

- Insurance companies and other lenders providing mortgage loans

- Credit insurance companies

- Debt collection agencies

ENR register

Next to renewing the credit registration platform, the NBB wants to merge the existing credit register (CKP/CCP) together with the ENR. The ENR is a register for non-regulated registrations and is there to collect information on overdue debts and payment arrears from natural persons. It helps to limit the excessive indebtedness of individuals.

Until now, this information was collected in agreement with the credit institutions and was therefore not obligatory for all firms.

Reporting agents need to report credit contracts that are granted to natural persons into the new BECRIS data model as of January 2024. The NBB is looking at instrument and counterparty information, for both authorized and unauthorized credit. Where the latter was only voluntary reported via the ENR, its collected data will become obligatory for all institutions with BECRIS ICR.

What’s the timeline?

Key dates for the transition into BECRIS 2.0 are:

- On 15 January 2024 the NBB expects all reporting agents to start reporting their credit data into BECRIS. All new credit contracts and any updates happening from 1 January 2024 are to be registered and declared via BECRIS. In parallel, institutions continue their reporting in the existing CKP/CCP register.

- On 30 April 2024, the CKP/CCP register will be terminated.

- From 1 May 2024, all reporting of credit data, both corporate and private contracts, will happen with BECRIS.

What challenges do you need to prepare for?

- Changes to collected data.

All credit contracts are now in scope. Voluntary data (ENR), both positive and negative, will now be mandatory.

This will require amends to existing data collection, data models, and increased reliance on accuracy.

- Short delivery timelines.

New and updated contracts will need to be reported within 2 working days. There will be a greater need for data accessibility, accuracy, and timeliness.

- Event based reporting.

BECRIS reporting standards require reporting agents to deliver data triggered by events. New contracts and updates to contracts need to be reported. BECRIS only needs the altered attributes.

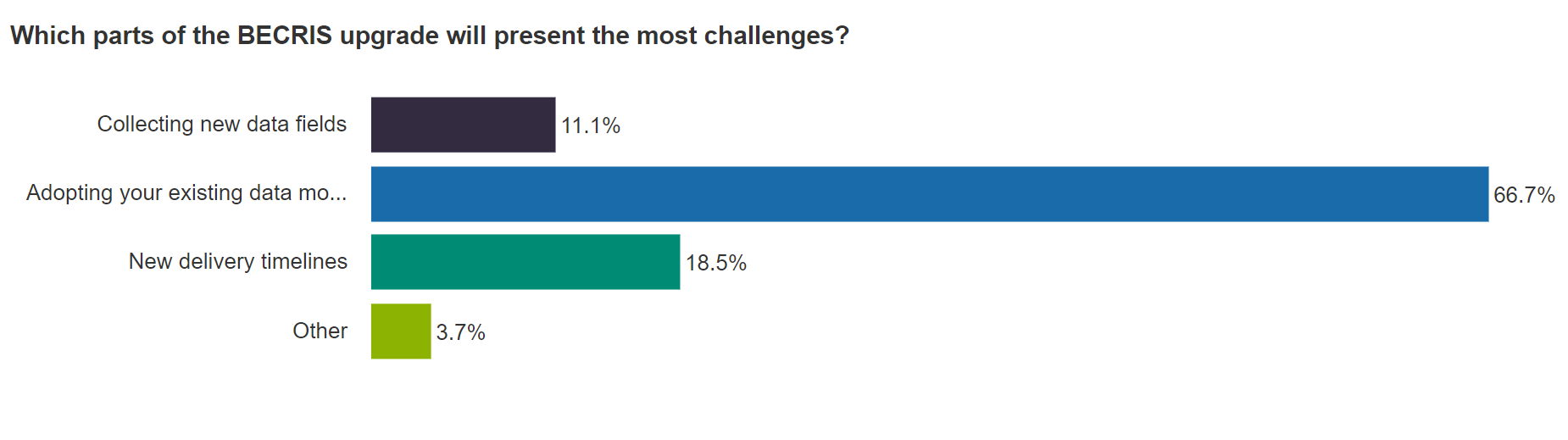

In a recent poll during the webinar, Reporting to BECRIS - Adopting an automated best-practice approach (Feb. 2023, fig. 1), over two thirds of the 27 respondents from Belgian banks voted that ‘adapting their existing data model’ would pose the greatest challenge.

Figure 1

As we have seen with AnaCredit, firms need to transform or replace their bespoke tools and processes to support this transformation. Starting early is key to success and those firms who adopt a strategic approach to enhancing or developing a more effective data model are most likely to achieve the adaptability, flexibility, stability and scalability required to future-proof their data management processes. By doing this, banks can be assured of not only meeting regulatory compliance but keeping the bar within reach whenever supervisors raise it again. Better managed data helps banks gain more time to manage business!

It’s time to act – Benefits of an automated approach

With less than a year to go, firms need to be acting now to ensure they meet the NBB’s deadlines.

Firms will need an end-to-end solution to capture and process the required data that offers a standard eligibility process in identifying any events following contract creation or updates.

Adopting an automated solution can help firms become highly competitive businesses that have greater command of commercial and supervisory environments. As demonstrated by the roll out of AnaCredit, a modern and centralized architecture is key to accurate, integrated, and standardized data. This presents numerous advantages in terms of time, cost-effectiveness, lineage and accuracy.

Speak to our experienced AnaCredit and BECRIS specialists to explore how OneSumX allows firms to deliver files within defined timelines, through automated integration to the BECRIS portal.

Glossary

CKP/CCP = Centrale voor Kredieten aan Particulieren (Central for Credits to Private Individuals)

CKO/CCE = Centrale voor kredieten aan onderneming (Central for credits to legal entities)

ENR = Not regulated Registrations for overdue payments

ICR = Individual Credit Register

CCR = Corparate Credit Register

NBB = National Bank of Belgium

ECB = European Central Bank

BECRIS = Belgian Extended Credit Risk Information System

AnaCredit = Analytical Credit dataset