Track regulatory developments across a list of global agencies

Products

Regulatory Change Management for Insurers

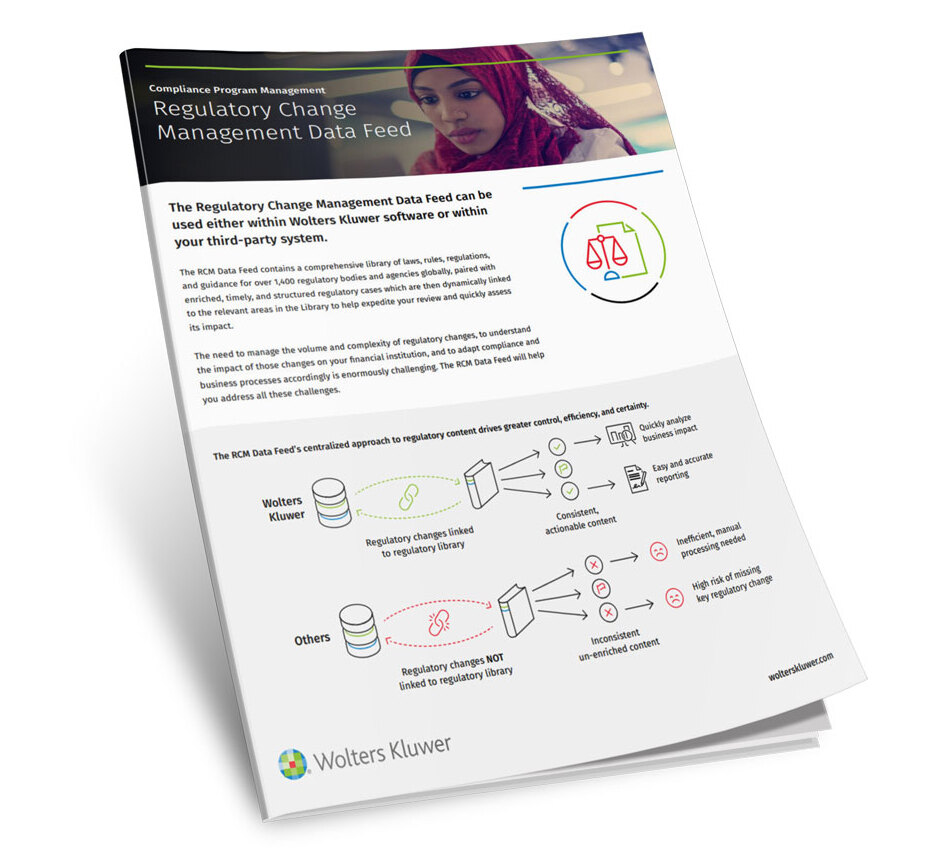

OneSumX for Regulatory Change Management treats compliance holistically and provides insurers with a centralized and automated approach that drives greater control, efficiency and certainty.

Download the Solution Overview →

NILS™ Feed Plus

A chief concern for today’s compliance and regulatory affairs professionals

is keeping pace with the ever-changing and increasingly complex regulatory

environment.

Download the Product Sheet →

Give us 30 minutes

Related Products