In parts I and II of our Accountancy Practice Management for Future-Fit Growth series, we explored new possibilities with KPI monitoring and practice management workflows. In this third part, we’re looking at business intelligence.

At Wolters Kluwer Tax & Accounting UK, we combine almost two centuries of deep domain knowledge with advanced technology – in order to facilitate professional decision-making with confidence. Business intelligence is a key tool used to inform decision-making in many top professional services organisations – and particularly in many future-fit practices.

You’re probably familiar with the term ‘business intelligence’, since researchers have been writing about it since the 1950s. Business intelligence vendors began emerging in the 1970s, with tools to help companies access and organise data.

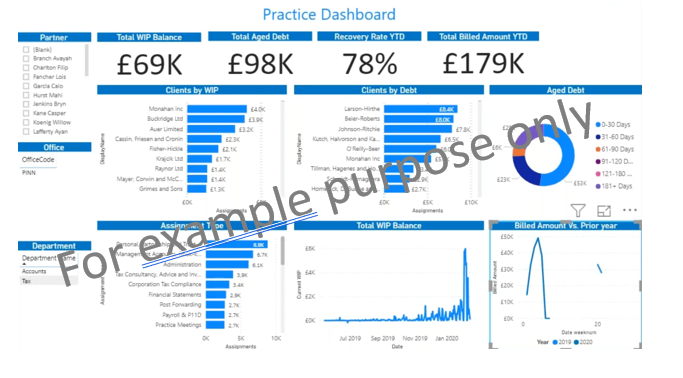

Today, business intelligence has grown up. It is driving future-fit growth at accountancy practices across the world. By combining analytics, data mining and visualisation with the right tools and infrastructure, practices can make more data-driven decisions.

(data and information for demonstration purposes only)

Accountancy practices are now using business intelligence to:

- Analyse areas of potential profitability

- Ensure adequate cash reserves

- Manage chargeable and non-chargeable timesheets

- Forecast cash flow

- Improve overall practice management

Do Practices Need Business Intelligence?

Picture the following scenario. An accountancy practice has 20-30 spreadsheets that circulate throughout the business. They are owned by various advisors who all input data. The manual work is time-intensive. There are issues with data quality and consistency.

Not all practices will have this experience. For some of them, manual reporting works sufficiently.

However, others worry that they cannot stay relevant if their data is only run manually, whether on a weekly or monthly basis. Timely data is everything. These practices often want to drill down into timely metrics pertaining to clients, partners and various other parties. Consequently, many want to move away from Microsoft Excel, which may be driving inconsistent and outdated reporting. They would then move to using one set of dashboards across the practice, which everyone can see and interact with.

The power of business intelligence is its efficiency and robustness. In our scenario above, the practice could draw all the data from those 20-30 spreadsheets and load it into a business intelligence system. Unlike a traditional report, business intelligence is a ‘build once, build for everybody’ situation. Practices can apply routines to that data on an automated hourly basis. This eliminates the manual overhead of reporting.

How Will We Know When We Need Business Intelligence?

With our ‘future-fit’ theme in mind, accountancy practices should ask themselves some frank questions.

- Do you spend lots of time in meetings organising spreadsheets before you even discuss growth plans for your practice?

- Would it benefit you to aggregate data from multiple sources into one place and visualise it?

- Would a system that automatically refreshed that data every hour, without manual intervention, save you time?

- Could you introduce some more advanced strategy, such as gamification to demonstrate performance visibility?

Many of our customers are already asking such questions. Our Wolters Kluwer strategy involves continuous innovation and enhancing our expert solutions suite for professionals. To accommodate their future-fit needs, we offer a customisable set of business intelligence dashboards – using the data housed in CCH Central. To find out more about CCH Central, click here for more product and feature information. Alternatively, you can book a demo here.