Background

Remember when Margaret Thatcher was elected Prime Minister of the UK, Sony introduced the Walkman, the American Embassy in Tehran was over-run and Russia (that time) invaded Afghanistan? The year was 1979.

In Australia, an ambitious young Federal Treasurer by the name of the Right Honourable Mr John Howard introduced the current version of s 100A into the ITAA 1936 (Act No 12 of 1979). Its rationale, explained at paragraph 18 of the Explanatory Memorandum, was to counter tax avoidance arrangements where a specially introduced low tax, or tax exempt, beneficiary was made presently entitled to income of a trust estate in such a way that the trustee was relieved of any tax liability on the income.

Little did anyone know at the time that the true import of the section would emerge decades later.

S100A dissected

Section 100A applies where a beneficiary who is not under any legal disability becomes presently entitled to a share of the income of a trust estate by virtue of what is termed a reimbursement agreement. This is defined as an agreement that provides for money to be paid, property transferred, or services or other benefits provided to someone other than the beneficiary: s 100A(7).

Where the provision applies, the income is not treated as assessable income of the beneficiary under s 97 of the ITAA 1936 but rather the trustee is assessed on the income under s 99A at the top marginal rate.

Importantly, s 100A(8) excludes from the scope of s 100A any agreement that was not entered into or carried out for a purpose of securing for any person a reduction in that person’s income tax liability in respect of an income year. Furthermore, s 100A(13) excludes from the scope of the provision an ordinary family or commercial dealing.

Transactions at risk

The concept of a reimbursement agreement is so broad that many common instances involving trust distributions are exposed to its application. Until recently it had largely lay dormant in the ATO’s arsenal, which has probably contributed to many practitioners operating in ignorance of, or unrestrained by, the provision.

In fact, consideration should always be given to whether a reimbursement agreement exists triggering s 100A whenever a trustee of a discretionary trust makes a distribution in any of the following circumstances:

- to an individual on a low tax rate

- to a foreign resident where the net income of the trust includes foreign sourced income, or is otherwise subject to withholding tax in Australia

- to an entity with tax losses

- to a company of which the shareholder is the trustee with the result that the company has no option other than to distribute the income it receives back to the discretionary trust.

If in any of these circumstances there is evidence that the beneficiary subsequently made, for example, a payment whether by gift or dividend to another person (especially another beneficiary on a higher rate) then the section is prima facie applicable. Particularly common transactions on notice include:

- applications of trust income by a trustee on behalf of a low-income adult beneficiary to meet expenses attributable to them

- the retention of income in a trust appointed to a low-income beneficiary

- so called washing machine arrangements whereby income is appointed to a private company and then distributed back to the trustee by way of a franked dividend.

Existing guidance on the provision

Since 2014 the ATO has provided some guidance on its web site: https://www.ato.gov.au/General/Trusts/In-detail/Trust-entitlements---draft-guidance/Trust-taxation---reimbursement-agreement/. However, this is limited and a more detailed consideration has been forthcoming for some time.

Caselaw

The section has been considered in a number of cases, most particularly: FCT v Prestige Motors Pty Ltd [1998] FCA 221; Idlecroft Pty Ltd v FCT [2005] FCAFC 14; Raftland Pty Ltd as trustee of the Raftland Trust v FCT [2008] HCA 21 and, recently, Guardian AIT Pty Ltd ATF Australian Investment Trust v Commissioner of Taxation [2021] FCA 1619 (on appeal to the Full Federal Court).

The latter case involved a washing machine arrangement. The Court found for the taxpayer on the basis that there was no reimbursement agreement in place at the time of the transactions. Furthermore, the arrangement fell within the definition of ordinary family or commercial dealing as the transactions were designed to achieve the aims of risk minimisation and wealth accumulation.

In addition, the Court also determined that there was no tax avoidance purpose within the meaning of s 100A(8). This section requires the hypothesis to be formulated as to what income tax would become payable if the relevant agreement had not been entered into. The Court preferred the counterfactuals posited by the taxpayer, both of which would not have generated the tax liability asserted by the ATO.

In this author’s opinion it is conceivable that this decision will be reversed on appeal. The Full Court might well infer a loose reimbursement arrangement from the outset that evolved and took shape over the years, that a distinction is to be drawn between objective purpose and subjective motivation, that the complexity and circuity of the transactions disqualify them from the description ordinary family or commercial dealing and that the Commissioner’s counterfactual was not unreasonable.

Draft Ruling TR 2022/D1

On 23 February the long-awaited draft ruling on the application of s 100A issued in the form of TR 2022/D1. While the draft ruling dissects the elements of the section in detail, it is really the nine examples that are most insightful. Of these, examples 4 and 9 stand out to the author as illustrations of common scenarios which practitioners will need to be mindful of.

Example 4 – trust entitlement gifted to trustee

This example details a distribution to an adult full-time student (determined so their taxable income does not exceed certain marginal tax rate thresholds) that is then gifted back to the trustee. The transaction is said to call for an explanation. An arrangement between family members, which achieves a particular favourable tax result but cannot otherwise be seen to achieve any familial object, will not be an ordinary family or commercial dealing simply because it is among family members.

The example provides that should the beneficiary be gifting their entitlement back to the trustee every year, it may be reasonable to infer that the dealing is not made for the furtherance of any familial or commercial object and was instead made for the reduction of tax. Other factors may support this interference, such as if the trustee loaned the funds to a parent on interest-free terms for an undefined period, or instead of gifting back to the trust the beneficiary gifts their trust entitlements directly to the parent or applies their trust entitlements to repay the parent for costs incurred on their maintenance, education and financial support while the beneficiary was a minor.

Example 9 – circular flow of funds

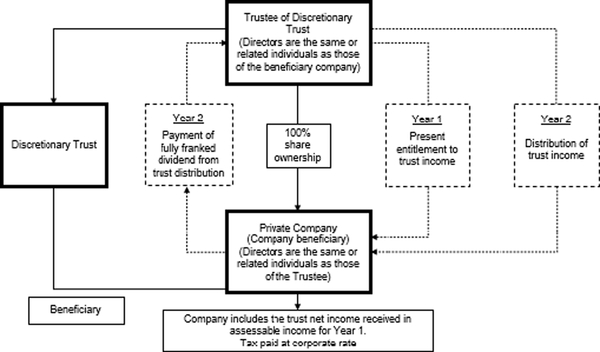

In this example a trustee of a discretionary trust owns the shares in a private company that is also a beneficiary of the trust. The directors of the trustee company and the beneficiary company are the same (or related) individuals.

The trustee makes the company beneficiary presently entitled to all, or some part of, trust income at the end of year 1 and distributes it to the company in year 2 before the company lodges its year 1 income tax return (thereby avoiding the application of Division 7A). The company includes its share of the trust’s net income in its assessable income for year 1 and pays tax at the corporate rate.

The company pays a fully franked dividend to the trustee in year 2, sourced from the trust distribution, and the dividend forms part of the trust income and net income in year 2.

The trustee makes the company presently entitled to all, or some part of, the trust income at the end of year 2 (possibly including the franked distribution). The arrangement is repeated.

It is suggested that there is a benefit to the trustee. The agreement provides for the payment of income from the trustee to the company on the understanding (inferred from the repetition in each income year and their common control) that the company would pay a dividend to the trustee of a corresponding amount (less the tax paid). This appears designed to achieve a reduction in tax that would otherwise be payable had the trustee simply accumulated the income. It would not be considered to have been entered into in the course of ordinary dealing as the ownership structure and, particularly, the perpetual circulation of funds, do not appear to serve ordinary commercial purposes.

This example approximates the facts of Guardian’s case and so the appeal outcome will clearly be instructive.

Draft Practical Compliance Guideline PCG 2022/D1

Accompanying the draft ruling was draft Practical Compliance Guideline PCG 2022/D1: section 100A reimbursement agreements — ATO compliance approach. The draft PCG seeks to assist taxpayers in determining the risk of ATO engagement where s 100A may have an application. It has an effective commencement date of 1 July 2022 as the current ATO guidance on s 100A will continue to apply to arrangements entered into before that date where the guidance provides a more favourable outcome to the taxpayer than the draft PCG.

The draft PCG provides a risk assessment framework with four risk zones as detailed in the following diagram taken from the draft PCG:

| Risk zone |

Description and compliance approach |

|

| Low |

White zone | The white zone applies to arrangements entered into in income years that ended prior to 1 July 2014. Except as described at paragraph 13 of this Guideline, we will not dedicate new compliance resources to consider the application of section 100A to arrangements in the white zone. |

| Low |

Green zone | The green zone applies to arrangements that are described in paragraphs 17 to 21 of this Guideline. We will not dedicate compliance resources to consider the application of section 100A to arrangements in the green zone. |

| Medium | Blue zone | The blue zone applies to arrangements that do not fall within any of the other zones described in this Guideline. Arrangements in the blue zone may still be subject to review by the ATO but are less likely to attract our attention than arrangements in the red zone. Examples of blue zone arrangements are described in paragraphs 25 and 26 of this Guideline. We may contact you to understand your arrangement and resolve any areas of difference including whether section 100A applies to your arrangement. |

| High | Red zone | The red zone applies to arrangements that are described in paragraphs 30 to 45 of this Guideline. We will conduct further analysis on the facts and circumstances of your arrangement as a matter of priority. If further analysis confirms the facts and circumstances of your arrangement are high risk, we may proceed to audit where appropriate. |

Although the ATO will not take compliance action in relation to an arrangement in the green zone taxpayers are advised to document how their circumstances meet the requirements of the zone.

Taxpayer Alert TA 2022/1 — Parents benefitting from the trust entitlement of their children over 18 years of age

Accompanying the draft ruling and PCG was Taxpayer Alert TA 2022/1: Parents benefitting from the trust entitlement of their children over 18 years of age. This Alert deals with the scenario of the appointment of trust income to adult children that is not paid to them but rather to their parents to offset expenses paid in relation to usual parental responsibilities. It states that these arrangements may be caught by s 100A or s 95A(1) and 97(1) of the ITAA 1936 may apply to treat the parents as presently entitled to those amounts. Alternatively, Part IVA may apply.

Although these arrangements are specifically covered in the draft ruling and PCG on s 100A the fact that an express Alert has been issued with immediate effect suggests that the arrangement will be a particular target of the ATO.

Draft Taxation Determination TD 2022/D1: Division 7A: When will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?

While outside the scope of this article it should be noted that issued alongside the three guidance documents on s 100A was draft Taxation Determination TD 2022/D1: Division 7A: When will an unpaid present entitlement or amount held on sub-trust become the provision of ‘financial accommodation’?

The draft determination reverses the ATO position on the effectiveness of the use of sub-trusts to avoid the application of Division 7A to UPEs. The ATO justifies this change of heart on recent case law adopting a very broad interpretation of the phrase ‘any form of financial accommodation’ that appears in s 109D(3)(b). The draft determination states that where the UPE is dealt with by way of sub-trust, if the corporate beneficiary allows a shareholder of the corporate beneficiary or an associate to use the funds held on sub-trust, this will be considered to be the provision of financial accommodation and also treated as a loan to the trust. This will be the case even when the use of the funds is subject to commercial terms.

This is a significant departure from the position set out in TR 2010/3 and PS LA 2010/4, both of which will be withdrawn with effect from 1 July 2022. In that guidance it was accepted that a private company beneficiary did not provide ‘credit or any other form of financial accommodation’ to a trustee where the funds representing a UPE were held on sub-trust and re-invested in the head trust on particular terms.

Importantly, paragraph 90 provides that the determination will not apply to entitlements arising before 1 July 2022 held on existing sub-trust arrangements nor sub-trust arrangements commenced on or after 1 July 2022 in respect of an entitlement arising before that date.

Commentary

Although some aspects of the ATO position on the interpretation of s 100A are contentious it is expected that most practitioners will wish to steer their clients clear of any dispute. Thus, the appointment of trust entitlements where there is an application of funds on behalf of a low-income beneficiary or the retention of an entitlement by the trustee will need to be approached with great caution.