Consulting giant, McKinsey, recently published the results from its survey Risk and resilience priorities, as told by chief risk officers (CROs)1. Without a doubt, managing financial risk has gotten harder as the list of risks and thus list of priorities keeps growing for banks.

At Wolters Kluwer we have long preached the need for a holistic, integrated, institution-wide approach to risk management and the benefits it brings to banks. Our whitepaper, A Better Approach to Risk Management2, offers in-depth guidance on how to readjust your risk management strategies and create a universal risk view. Risk needs to be understood as one phenomenon, not broken down into specific risk siloes, and it’s imperative to look at how different risks influence each other, and how they can change over time.

The McKinsey survey questioned over 30 CROs in late 2021 and the results are insightful, offering strategic observations from the respondents. It can sometimes appear that the themes of risk management are stagnant; liquidity risk, capital worries, ESG and climate regulation confusion but the results offer pragmatic insights and strategies that shape institutional strategy and build operational resilience.

Regulatory readiness

Respondents of the survey ranked regulatory efforts as the ‘top time-consuming agenda’ and 60% of the respondents predict the number of staff at their institutions focusing on the reg agenda will rise in the next three years3. This is unsurprising to hear, considering compliance burdens are increasing for new regulatory areas, with refinements of existing rules seeking to harmonize cross-border practices. Globally speaking, the aim is to ensure regulatory policies and risk management decisions are consistent across markets, McKinsey says.

Such regulatory goals though require scalable, flexible, and adaptable solutions to prepare for sudden future shifts that require implementation. Regulatory compliance solutions need to be able to gauge how different risks are connected.

Yet, as our paper discusses, many departments within banks are siloed4. A need exists to understand how various risks impinge on each other and to optimize the balance of risk and reward. The paper stresses how a holistic risk management system can help integrate risk matrices organization-wide and offer appropriate solutions to help ease regulatory pressures.

The role of the risk function

Risk professionals need to build internal monitoring and regulatory reporting process to predict and swiftly act on evolving trends in the economic and regulatory environment, as well as to create a competitive edge for their institutions.

Doing so requires scenario-based foresight, monitoring of early upheaval indicators and crisis-response capabilities. Such measures can help banks become anti-fragile and capable of absorbing the shocks, while pivoting and navigating new market realities. ESG presents the highest reputational risk for risk managers of recent times. Risk managers must bring clarity to this space that is already so crowded.

Broad spectrum risk analysis, as Wolters Kluwer’s paper points out, can reveal how much risk factors an institution faces and the degree of interconnectedness amongst its risk, which can impact a bank’s bottom line and how it assesses risk.

For instance, adopting reverse stress testing can help banks gauge how they are doing and what improvements need to be made. Working backwards can achieved desired goals by setting key risk and performance indicators based on institutional risk appetite, business matrices and strategic goals. By making the necessary adjustments along the way under multiple scenarios, firms can attain an optimum mix of exposures in their portfolios.

Ultimately, the risk function remains central to resilience building and institutional strategy within the bank.

Digitization – new technologies with the age-old problem of poor data

A key discovery of McKinsey’s survey is that digital transformation is needed to lower the substantial execution and operational risks. Digitization can act as the means to achieve efficiencies in traditional risk areas.

Decision-making aided by digitized and automated controls can help reporting, monitoring, and maintaining data lineage for better traceability. The needed improvements in reporting and monitoring will have to be achieved largely through improving risk-function efficiency. Budgetary restraints remain, and existing infrastructures can be burdensome, even after implementing data-aggregation approaches for BCBS 239, almost 10 years ago.

Whilst the importance of digital transformation was addressed in the report, it gave scant attention to the issue of data lineage and accuracy. This is something which the Wolters Kluwer paper delves into deeply, along with the connection between consistent data and accurate risk calculations.

“Poor data quality” was the greatest concern for 58% of the CRO respondents. “Half of respondents were also concerned that data issues will most hinder usage of advanced-analytics models. Regarding risks related to models, potential data issues ranked ahead of inaccurate models, model misuse, or privacy and security concerns,” the report said5.

Ultimately, poor data dampens the effectiveness of advanced-analytical models and creates inaccurate results. Holistic solutions that are all-encompassing and fully integrated across all functions and departments, backed by a common data repository accessible by all users are imperative.

Future-proofing and building an agile risk function

Many departments have long worked in silos – with stories about turf wars, uber-competitiveness, lack of cooperation and proverbial ‘internecine warfare’ within the same institutions, common throughout the industry.

Operating in such a way, undermines the need to understand how various risk factors interact with each other; only when banks can get a handle on how given risk factors impact each other can they optimize the balance of risk and reward.

Banks and financial firms more generally need a better, more comprehensive and actionable way to measure, mitigate and manage financial and regulatory risk.

Risk managers need a solution that gives one consistent view across different risk factors, allows for sophisticated scenario analyses, and can perform stress testing under both internal and regulatory metrics. A fully scalable, dedicated data management platform providing analytical reporting in a fraction of the time is also an essential.

Find the right partner and achieve greater efficiency

Source: www.mckinsey.com/capabilities/risk-and-resilience/our-insights/risk-and-resilience-priorities-as-told-by-chief-risk-officers

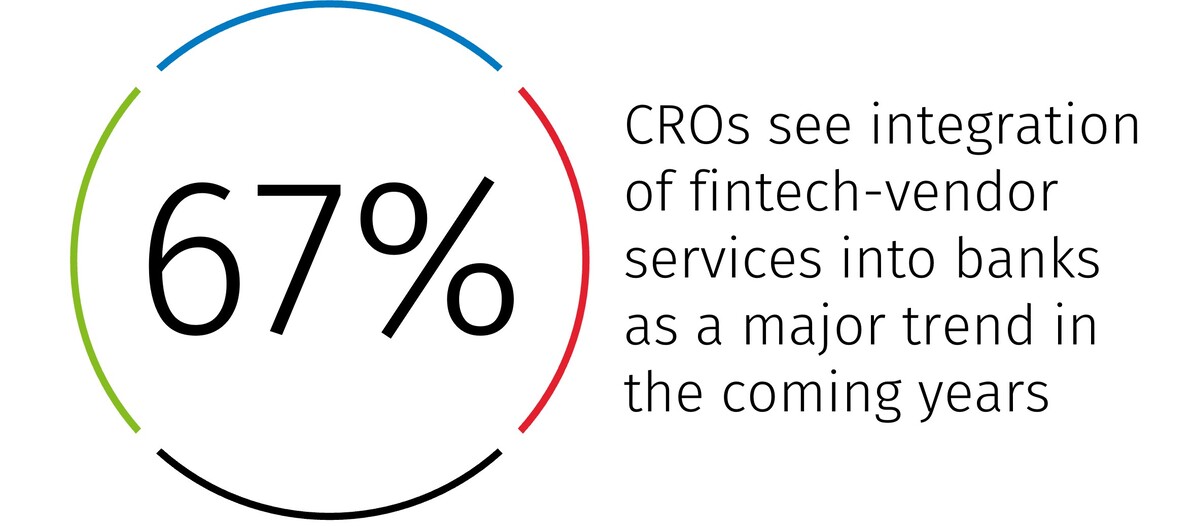

According to McKinsey, 67% of respondents “see integration of fintech-vendor services into banks as a major trend in the coming years”6.

Between the new competitive realities that the industry face and the new and greater risks popping up in the wider world, all risk managers will need to improve their performance. Take a look through our detailed white paper to get in-depth guidance from our experts on future planning, whether that’s through target setting or stress testing, crisis management and how to optimize business-as-usual practices.