Covid-19 is underscoring the importance of liquidity risk management towards financial stability, especially during a crisis. The last truly global crisis – the credit crunch of 2008/2009 – created a squeeze on liquidity, that forced several high-profile financial institutions out of existence and left many others lurching towards insolvency.

The impact of this pandemic is different for a host of reasons, but the threat remains of a similar, or even greater magnitude.

The pandemic has put a massive brake on economic activity globally and across many areas of human endeavor. Entire industry sectors have gone dormant for months, with hospitality, travel, and tourism particularly hard hit. As businesses dig into reserves and seek sources of funding to keep the doors open, access to liquidity will continue to tighten.

Businesses everywhere are already operating at far lower levels of activity than normal. Banks have had little choice other than to provide forbearance on mortgages and commercial loans, and in many cases financial institutions have been forced to dip into their liquidity buffers. This broad slump in credit quality that has accompanied the Covid-19 pandemic is making it more difficult for banks to measure liquidity risk and get a firm grasp on their funding situations.

Basel III post-credit crisis regulatory measures, such as the introduction of the liquidity coverage ratio (LCR), and net stable funding ratio (NSFR) combined with central banks’ ongoing quantitative easing activities, have provided only a limited level of protection. However, with the world now facing a resurgence of Covid-19 infections, even healthy companies are facing further liquidity shortfalls as funding sources become more scarce – a development that could evolve into an acute solvency issue for many corporations and banks.

For many banks, the larger liquidity buffers introduced post-credit crisis have become the default position with respect to liquidity risk, but there is a fear that widespread quantitative easing may be clouding banks’ views, in which case, some banks will look to hold overly conservative levels of capital to compensate for the inadequacies of their internal systems for managing liquidity. So, what is the optimal level of liquidity that banks should be looking at, particularly in cases where recent policy pronouncements have been guiding banks towards holding more conservative buffers?

Why liquidity risk management matters

Declining credit quality across the board – but most visibly in the retail sector – is exacerbating this stress on liquidity. As a result, some banks are struggling to understand their overall liquidity positions and are finding measurement of liquidity by asset class an impossibility. Earlier this year, as a result of the effect of Covid-19, many firms – both financial institutions and corporations – enhanced cash flow flexibility by attempting to sell some of their stock of high-quality liquid assets, which often formed a major component of their liquidity and capital buffers. Market depth and liquidity almost ceased to exist for a period, and prices experienced severe volatility.

It is has now become critical for financial institutions to not just measure liquidity, but also to consider every possible scenario that could impact their overall liquidity profile. The risk event (in this case Covid-19) has translated into adverse credit, liquidity, market, interest-rate and business risk scenarios. This illustrates how the crisis has had an unexpected impact, and raises the question of whether it could have been modeled through stress- testing – so that the complete risk picture could be formed, and in turn would have given management a comprehensive view. If so, it would help them assess the probability of such a grim scenario, and take necessary actions (i.e. maintain a larger liquidity buffer and solvency).

While a bank may understand the risk factors it faces, capturing these and building systems to assess the firm’s reaction to various liquidity scenarios can be a complex task; but with the right strategy, they will be better equipped to manage these processes more efficiently, especially in times of crisis.

Many bank system architectures reflect the disparate silos within their structures, which has traditionally made the understanding of liquidity risk at the top of the house a laborious and slow process. To ensure liquidity management programs are effective, it is imperative that financial institutions get a consolidated view of their sources of liquidity risk. This includes fast and efficient access to clear, accurate, and consistent data across multiple business lines, and putting in stress-testing methodologies and processes to measure the response to liquidity scenarios. To bring it together is not a

simple process.

Approach from different jurisdictions

The pandemic is now highlighting the requirement throughout the Asia-Pacific region, where the issue of liquidity is acute, with some markets like Indonesia still suffering from the effects of measures implemented after the currency crisis of 1996. Australia’s APRA and ASIC regulators, for example, have acknowledged the impact of Covid-19 on credit quality and liquidity, and provided guidelines on enhanced capital buffers. Other regulators are expected to follow. The need for true liquidity management has also been a topic of discussion in the Americas and Europe for some time.

The EPS reforms in the U.S. and the LAR framework in Canada, for instance, have introduced a buffet of more advanced liquidity metrics (FR 2052a, NCCF, LMM), stresses (LST, ILAAP) and reporting, and very recently the Federal Reserve Bank in the U.S. issued the final ruling on the NSFR ratios, which will go into effect by July 1, 2021. This framework has proven to be very resilient for institutions during the Covid-19 pandemic. In Europe liquidity has been high on the agenda since the GFC and liquidity buffers were implemented, however during the pandemic very few banks have utilized their buffers despite stricter NSFR ratios.

No two crises are the same, and any stress-testing program needs to be designed to fit the situation at hand. This latest crisis for example, has demonstrated that previously held axioms around supposedly safe and highly liquid assets, and the ability to quickly turn them into cash during a crisis, were not as solid as participants had believed.

Data management challenges

To weather the liquidity storm posed by Covid-19, banks need to take proactive measures. They need to institute steps to identify potential gaps in their liquidity requirements and formulate plans on how to address them, as well as ensure their cash-flow management processes and calculations are robust.

Best practice demands dynamic cash-flow analysis that allows organizations to differentiate between future flows that are contractual from those that are based on assumptions. Dynamic cash-flow generation should be capable of automatically incorporating behavioral assumptions such as prepayments, non-maturing deposits, and other uncertain future flows into the analysis.

Measuring dynamic cash flow analysis is imperative. In addition, with dynamic hedging, liquidity gaps can be bridged and mitigated. Also underpinning sound liquidity risk management practices is the need for access to clean and accurate data, on which to build a robust framework. Each step requires clean, validated data with the ability to drill back to source systems. This ensures accuracy in the analytics and reporting needed to help managers perform liquidity management (i.e. daily measurement, follow-up and steering, crisis management, optimization of funding sources, and stress-testing).

Scenario impacts during a crisis

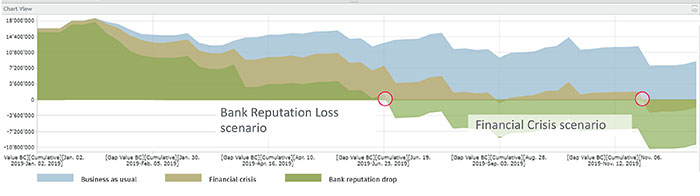

However, due to firms’ siloed organizational structures, data may be inconsistent across lines of business and asset classes, which may use different and specialized solutions. Firms often put in place a data warehouse to address the difficulty in collecting and integrating group-wide data. But in many cases, it is not properly managed, and requires a series of manual processes and interventions to leverage it in any meaningful way. Failure to adequately manage these risks places organization’s funding and reputation, and indeed existence, at stake. In the above figure, we show how with the deterioration in the macro factors, a bank’s liquidity suffers a serious crunch, and the projected liquidity can move into a negative figure creating contingency and stress.

In conclusion

While liquidity management is an involved science, it is also part art, in the way a bank can structure and design requisite systems. Longer term approaches to liquidity and solvency demands that banks invest in a risk infrastructure that ensures the widest instrument coverage, cash flow granularity and dynamic simulations – and fulfils the demands of regulatory liquidity calculations at the same time.

Covid-19 and the system-wide impairment it has brought about makes it urgent that banks re-evaluate their liquidity risk capabilities – in terms of withstanding such stress scenarios in the future. A strategic platform that integrates data, analytical methodology and regulatory reporting would be the need of the hour.