Finance transformation: Unleashing the potential of data

A transformation project that integrates data, processes, and people in a single platform optimizes decision-making and planning.

The desire to squeeze more value out of the finance department is driving many companies to embark on finance transformation projects. Put simply, these projects involve implementing measures to free up the finance team from much of its routine, lower-value work. That’s mostly accomplished by automating data management, reconciliation, and other accounting processes.

The “what” and “why” of finance transformation are straightforward. The “how” is where things get tricky. Most important is that finance transformation is largely a matter of digital transformation and how it restructures the function. The centerpiece is the integration of people, data, and processes onto a single platform.

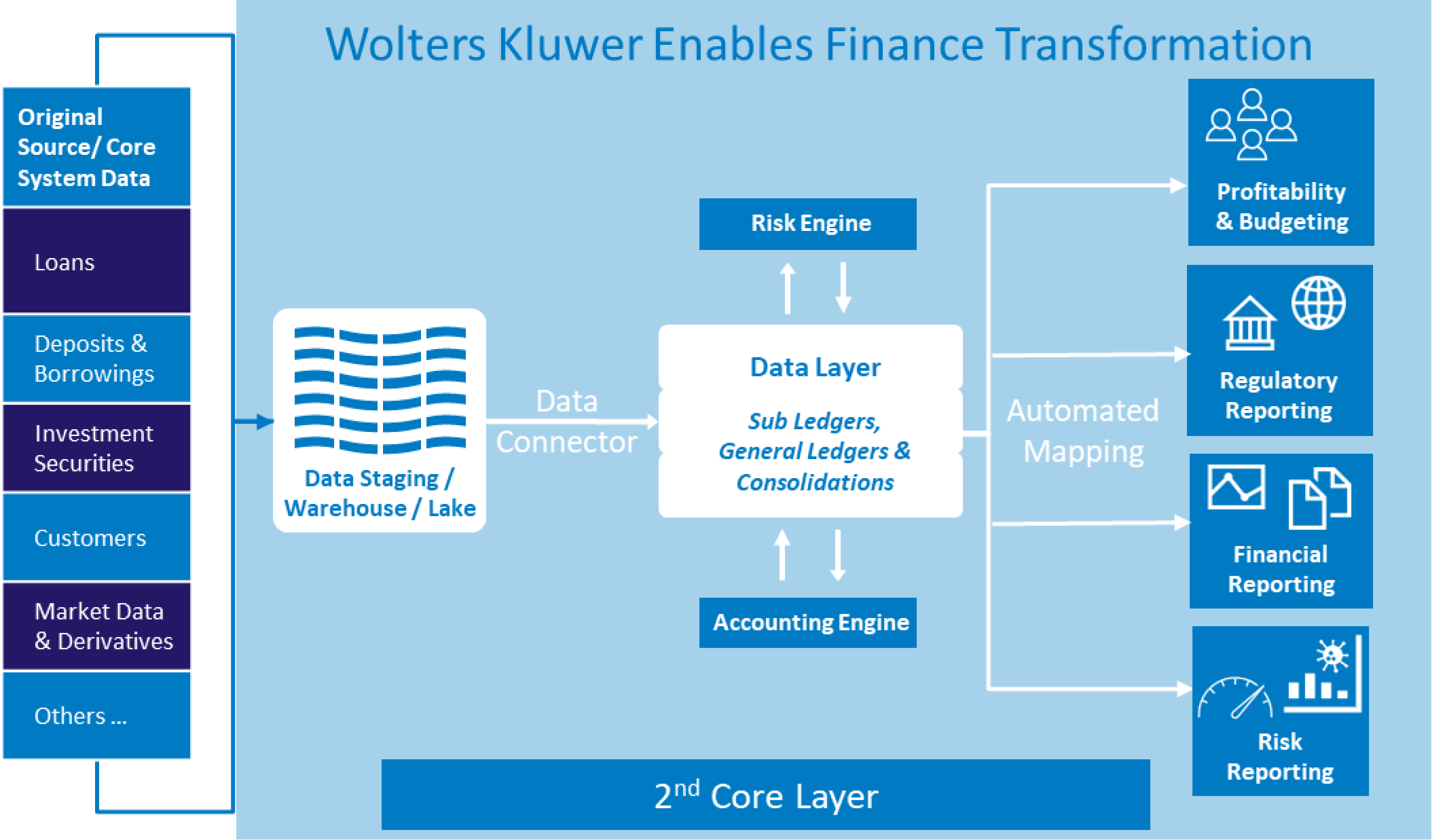

A solution that facilitates this objective will have an architecture that echoes the structure of the function you want to build out. Advances in data processing speed, storage capacity, and system design will permit more connections among different functions and those connections will be made faster and more nimbly because there are fewer steps involved in making them.

Simple and Complex Tasks

The key to success in finance transformation is to understand and make the most of all the ways a fully integrated data solution can take charge of routine processes from front to back. While managing the routine, the solution also will generate better data, more rapidly for the higher-level analytics that finance uses in budgeting, forecasting, planning, and other key operations. Getting the “how” right will help to optimize decision-making, operational efficiency, and ultimately profitability.

The typical company’s systems are likely to move data from one place to the next in a linear fashion — from customer and transaction data to the general ledger, to risk analytics, financial reporting, and so on. That makes them slow and error-prone. As inaccuracies and inconsistencies creep in, the procedure gets bogged down with backfilling. Checking and reconciling the work already done further slows progress.

An additional hindrance is the fragmented, piecemeal nature of many technology solutions. There may be a core system, then a separate, standalone general ledger, as well as other systems that individual departments rely on to do the same job, each in its idiosyncratic way, amplifying the sluggishness and assuring additional errors and reconciliations.

A more effective design would store all data, regardless of origin and type, in a common format in a single warehouse that serves as the sole data source for users across the organization and for all purposes. This single data layer, covering general ledger, sub-ledgers, and consolidations would feed directly into risk and accounting engines, making it immediately accessible for budgeting and profitability analysis, and indeed all finance purposes. This design essentially creates a second, fully digital core layer.

The Whole Picture

The result of a streamlined architecture is reduced cost and complexity, and more accurate and consistent information delivered faster and with fewer steps. Beyond that, and this is what creates the means to achieve finance transformation, it permits all data, at every level of granularity, to be analyzed by staff in all departments in ways that make the most sense and provide the greatest value. Everyone is on the same page, but they can read the material in the language that is native to each user.

Having such information available in a way that presents multiple, nuanced perspectives paints a more complete picture, resulting in faster, better decisions down to the individual contract and customer level. The data can be aggregated and analyzed based on location, activity, or other useful criteria and transmitted more efficiently back up to senior finance leaders. Contract or report details can be examined for multiple purposes — reporting, internal accounting, internal risk management, or whatever is required — and progress on each task or project can be tracked, increasing operational efficiency.

Having this information at the right people’s fingertips makes closing an easier process. It also provides a sharper, more timely view of current conditions and a useful glimpse into the future. Profitability analytics can be generated in days rather than weeks. This lets you see where the organization is meeting its goals and — using simulations, plugging in forecasts, and tweaking them — determine where and how it should make adjustments. You can improve balance-sheet management and get a better handle on the impact that any change in the market landscape will have on cash flows and profitability.

An organization can better gauge meaningful changes as, or even before, they happen. Teams can tease out more readily how conditions in the economic, financial, and commercial environments are developing, make better decisions in response, and, in the case of senior finance executives, devise more effective and insightful forecasts and strategies that boost performance. As one example, more accurate, timely, and detailed budgets will better inform management, enhance financial performance and ensure accountability, further improving decision-making at all levels in a virtuous circle.

Up For the Challenge?

It all sounds great, but is the organization ready for it, and is it worth it to you to find out? A transformation can imply there’s a lot of work involved. Just how much depends on the state of current systems.

A finance transformation project may be easiest to implement for small to mid-sized entities, particularly a company that recognizes the benefits of digitization or may already be on the path to a digital future. If yours is such a company, you have reason to be confident in your ability to manage the upgrades needed to derive meaningful benefits from a project and enhance the finance team’s work with minimal disruption.

Implementing a project for a larger, more complex company is possible, but may be a more formidable undertaking. Beyond the sheer scope and scale involved, a large enterprise may be laboring under a culture of inertia and the siloed organizational structure and data systems that tend to go with it.

If a project seems difficult to implement, it could be a sign that your existing tech is not up to the challenges the company will be facing. Put another way, technological sophistication makes finance transformation possible and necessary at the same time.

A Matter of Timing

If current conditions make you skittish about undertaking a significant finance transformation initiative, keep in mind that as risks rise, so does the threat to the top and bottom lines. When revenues and profits are harder to come by, it becomes imperative to enhance the effectiveness of your finance team.