With the implementation of the new Investment Firms Prudential Regime (IFPR), the FCA is aiming to streamline and simplify the prudential requirements for solo-regulated investment firms in the UK. While key details of the new rules remain to be finalized, panellists on a recent Wolters Kluwer webinar, hosted by A-Team Group, emphasized that the IFPR represents a major change for UK investment firms, making it critical that firms act now to adequately prepare for the new regime.

Under IFPR, which takes effect in January 2022, regulated entities will need to prepare for changes to own funds, liquidity and capital requirements. The panellists on the webinar - Laurence Blake, Head of Risk at Jane Street Financial; Alan Sievewright, Deputy CFO at Baillie Gifford & Co.; Andrew Lowin, Technical Director, European Financial Services Regulation, Compliance & Regulatory Consulting, at Duff & Phelps; and Kwame Frimpong, Regulatory Product Manager at Wolters Kluwer FRR - acknowledged that UK regulators were still working on details, but suggested that much of the requirement will resemble the EU’s own IFD/IFR, due to come into effect this June.

According to an audience poll taken during the webinar, only 11% of attendees had not yet started their preparations. One-third of respondents had initiated their IFPR project, and more than half were either conducting analysis and design for their response or were looking for a market solution.

The UK regulation will apply to all MiFID-authorized, Collective Portfolio Management Investment (CPMI) firms (i.e., UK UCITS ManCo and Alternative Investment Fund Management Firms permitted to undertake Additional Activities) and their UK parents and supervised firms, as well as non-small and non-interconnected firms (non-SNIs) and Class 2 firms. Panellists said firms need to understand their classification under IFPR, and suggested they refer to the FCA’s June 2020 discussion paper (DP 20-02) and first consultation paper on the topic (CP 20-24), and also check the EU rules on the EBA website. A second FCA consultation paper is due at the start of Q2 and will expand on client orders, assets under management and so-called K-factors governing client risk.

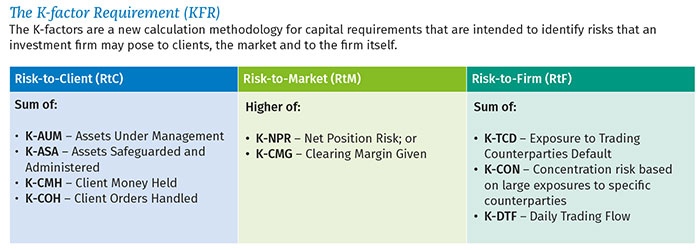

On the webinar, Wolters Kluwer’s Frimpong explained that K-factors take new approaches to calculating capital requirements for regulated investment firms, with methodologies aimed at identifying risks that the firm may pose to clients, to the market and to itself (see diagram, below).