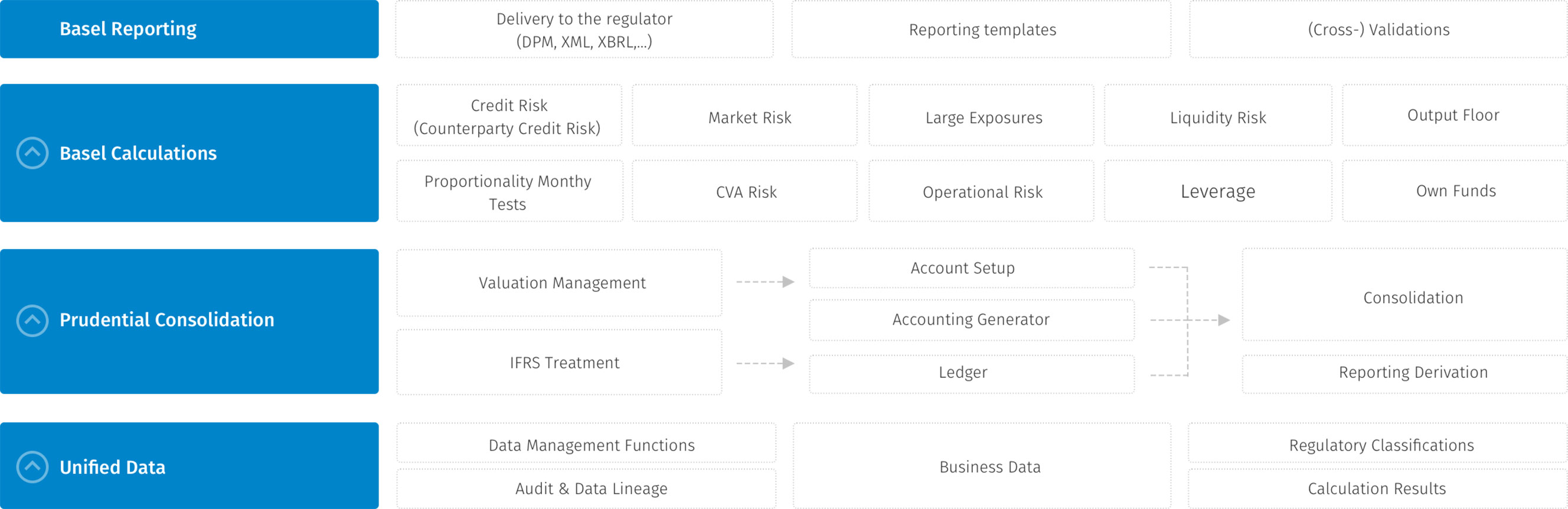

An integrated Basel solution

OneSumX for Basel solution covers standardized and advanced approaches across all bank sizes and risk types - from credit to market risk, through to operational, settlement, credit valuation adjustment, and counterparty credit risk. Not only can our technology and expertise ensure you are compliant with Basel II, Basel III reforms, UK Basel 3.1 standards, EU CRR3 and Basel IV implementation & reporting timelines, but your teams can make timely, informed decisions to manage risk more effectively, and optimize revenues.